UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

PROXY STATEMENT PURSUANT TO SECTION 14(a)

of the Securities Exchange Act of OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy |

| Confidential, for |

| Definitive Proxy |

| Definitive Additional |

| Soliciting Material |

Eaton Corporation plc

(Name of Registrant as Specified in itsIts Charter)

XXXXXXXXXXXXXXXX

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| OUR VISION | To improve the quality of life and theenvironment through the use of powermanagement technologies and services. | ||

| LEADERSHIP ATTRIBUTES | Our culture and what we value arerepresented in the attributes of allEaton employees. | ||

| ■ | Ethical:We are ethical. We play by the rules and act with integrity. | ||

| ■ | Passionate:We are passionate. We care deeply about what we do.We set high expectations and we perform. | ||

| ■ | Accountable:We are accountable. We seek responsibility and take ownership. We do what we say. | ||

| ■ | Efficient:We are efficient. We value speed and simplicity. | ||

| ■ | Transparent:We are transparent. We say what we think. We make itokay to disagree. | ||

| ■ | Learn:We learn. We are curious, adaptable and willing to teach whatwe know. | ||

Notice of Eaton Corporation plc'splc’s Annual General Meeting

MEETING AGENDA:

|

|

| ||

| Approving the appointment of Ernst & Young LLP as independent auditor for 2018 and authorizing the Audit Committee of the Board of Directors to set its remuneration; | |||

| 3. | Approving, on an advisory basis, the Company’s executive compensation; | |||

| 4. | Approving a proposal to grant the Board authority to issue shares under Irish law; | |||

| 5. | Approving a proposal to grant the Board authority to opt-out of preemption rights under Irish law; | |||

| 6. | Authorizing the Company and any subsidiary of the Company to make overseas market purchases of Company shares; and | |||

| 7. | Transacting any other business that may properly come before the meeting. |

Eaton House30 Pembroke RoadDublin 4, Ireland

February 29, 2016

Electing the 14 director nominees named in the proxy statement;

Approving a proposal to amend the Company’s (A) Articles of Association to make certain administrative amendments and (B) Memorandum of Association to make certain administrative amendments;

Approving a proposal to amend the Company’s Articles of Association to clarify the Board's sole authority to determine its size within the fixed limits in the Articles of Association;

Approving the appointment of Ernst & Young LLP as independent auditor for 2016 and authorizing the Audit Committee of the Board of Directors to set its remuneration;

Approving, on an advisory basis, the Company’s executive compensation;

Authorizing the Company and any subsidiary of the Company to make overseas market purchases of Company shares; and

Transacting any other business that may properly come before the meeting.

Proposals 1, 2, 3, 4 5 and 6 are ordinary resolutions requiring a simple majority of the votes cast at the meeting. Proposals 2A, 2B and 3 areProposal 5 is a special resolutionsresolution requiring at least 75% of the votes cast at the meeting. Each of these proposalsproposal is more fully described in this proxy statement.

Also during the meeting, management will present Eaton’s Irish Statutory Accounts for the fiscal year ended December 31, 20152017 along with the related directors’ and auditor’s reports.

Online proxy delivery and voting: As permitted by the Securities and Exchange Commission, we are making this proxy statement, the Company’s annual report to shareholders and our Irish statutory accounts available to our shareholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our annual general meeting and reduces costs significantly. The Notice Regarding Internet Availability of Proxy Materials (the “Notice”) contains instructions on how you can access the proxy materials and how to vote online. If you received the Notice by mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. The Notice has been mailed to shareholders on or about March 18, 2016 and provides instructions on how you may access and review the proxy materials on the Internet and how to vote.

If you hold your shares in your broker’s name and wish to vote in person at the annual general meeting, you must contact your broker and request a legal proxy. See page 7569 for additional information.

By order of the Board of Directors,

ThomasE.Moran

Senior Vice President and Secretary

March 18, 2016

16, 2018

YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO VOTE.

| YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO VOTE. |

| If possible, please vote your shares using the Internet instructions found in the Notice. Alternatively, you may request a printed copy of the proxy materials and mark, sign, date and mail your proxy form in the postage-paid envelope that will be provided. Voting by any of these methods will not limit your right to vote in person at the annual general meeting.Under New York Stock Exchange rules, if you hold your shares in “street” name through a brokerage account, your brokerwill NOT be able to vote your shares on non-routine matters being considered at the annual general meeting unless you have given instructions to your broker prior to the meeting on how to vote your shares. Proposals 1 and 3 are not considered routine matters under New York Stock Exchange rules. This means that you must give specific voting instructions to your broker on how to vote your shares so that your vote can be counted. |

If possible, please vote your shares using the Internet instructions found in the Notice. Alternatively, you may request a printed copy of the proxy materials and mark, sign, date and mail your proxy form in the postage-paid envelope that will be provided. Voting by any of these methods will not limit your right to vote in person at the annual general meeting. UnderNewYorkStockExchangerules,ifyouholdyoursharesin“street”namethroughabrokerageaccount,yourbrokerwillNOTbeabletovoteyoursharesonnon-routinemattersbeingconsideredattheannualgeneralmeetingunlessyouhavegiveninstructionstoyourbrokerpriortothemeetingonhowtovoteyourshares.Proposals1,2,3,5and6arenotconsideredroutinemattersunderNewYorkStockExchangerules.Thismeansthatyoumustgivespecificvotinginstructionstoyourbrokeronhowtovoteyoursharessothatyourvotecanbecounted.

| Date: | April 25, 2018 |

| Time: | 8:00 a.m. local time |

| Location: | Eaton House |

| 30 Pembroke Road | |

| Dublin 4, Ireland | |

Record date:February 26, 2018 Online proxy delivery and voting:As permitted by the Securities and Exchange Commission, we are making this proxy statement, the Company’s annual report to shareholders and our Irish statutory accounts available to our shareholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our annual general meeting and reduces costs significantly. The Notice Regarding Internet Availability of Proxy Materials (the “Notice”) contains instructions on how you can access the proxy materials and how to vote online. If you received the Notice by mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. The Notice has been mailed to shareholders commencing on March 16, 2018 and provides instructions on how you may access and review the proxy materials on the Internet and how to vote. | |

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on April 27, 2016:25, 2018: This proxy statement, the Company’s 20152017 Annual Report to Shareholders and our Irish Statutory Accounts for the year ended December 31, 20152017 are available atwww.proxyvote.comwww.proxyvote.com..

| Proxy Summary | 1 | |

| Proposal 1: | ||

| Communicating with the Board |

| Mailings to Shareholders in the Same Household |

| EATON2018 Proxy Statement and Notice of Meeting |

|

|

|

|

EATON 2016 Proxy Statement and Notice of Meeting

This summary is intended to provideprovides an overview of the items that you will find elsewhere in this proxy statement. As this is only a summary, weWe encourage you to read the entire proxy statement for more information about these topics before voting.

This proxy statement, the accompanying proxy form, Eaton’s annual report for the year ended December 31, 20152017 and our Irish Statutory Accounts for the year ended December 31, 20152017 will be made available or sent to shareholders commencing on or about March 18, 2016.16, 2018.

Throughout this proxy statement, all references to our Board of Directors (or its committees) or officers for periods prior to November 30, 2012, are references to the Board of Directors (or its committees) or officers of Eaton Corporation, our predecessor. Similarly, all references to the Company for such periods refer to Eaton Corporation.

This year there are six proposals on the agenda. Adoption of Proposals 1, 2, 3, 4 5 and 6 requires the affirmative vote of a majority of ordinary shares represented at the meeting byin person or by proxy. Adoption of Proposals 2A, 2B and 3Proposal 5 requires the affirmative vote of at least 75% of ordinary shares represented at the meeting in person or by proxy.

Proposals | Board Voting Recommendations | Page | ||

Proposal 1 | ✓FOR each nominee |

|

| |

Proposal 2 | ✓FOR |

| 19 | |

Proposal 3 |

|

| ||

|

|

| ||

| ✓FOR |

|

| |

Proposal4 | ✓ FOR | 62 | ||

Proposal5 | ✓ FOR | 63 | ||

Proposal 6 | ✓FOR |

|

| |

| EATON2018 Proxy Statement and Notice of Meeting | 1 |

BOARD AND GOVERNANCE FACTS

In addition to executive compensation practices that strongly link pay and performance, Eaton'sEaton’s Code of Ethics and Board of Directors Governance Policies help to ensure that we "do“do business right."” For more information about our Governancegovernance programs and Board of Directors, see Proposal 1 beginning on page 5.6.

Board and Governance Information | 2015 |

| Board and Governance Information | 2015 | 2017 |

| Board and Governance Information | 2017 |

Size of Board | 14 |

| Independent Directors Meet without Management Present | Yes | 12 |

| Independent Directors Meet without Management Present | Yes |

Average Age of Directors | 62.6 |

| Director Stock Ownership Guidelines (Readopted in 2015) | Yes | 63.4 |

| Director Stock Ownership Guidelines | Yes |

Number of Independent Directors | 11 |

| Mandatory Retirement Age | Yes | 10 |

| Mandatory Retirement Age | Yes |

Board Meetings Held in 2015 (average director attendance 95%) | 5 |

| Board Orientation and Continuing Education Program | Yes | ||||

Board Meetings Held in 2017 (average director attendance 95%) | 4 |

| Board Orientation and Continuing Education Program | Yes | ||||

Annual Election of Directors | Yes |

| Code of Ethics for Directors, Officers and Employees | Yes | Yes |

| Code of Ethics for Directors, Officers and Employees | Yes |

Majority Voting For Directors | Yes |

| Succession Planning and Implementation Process | Yes | Yes |

| Succession Planning | Yes |

Lead Independent Director | Yes |

| Comprehensive Sustainability Program | Yes | Yes |

| Comprehensive Sustainability Program | Yes |

EATON 2016 Proxy Statement and Notice of Meeting 1

| EATON2018 Proxy Statement and Notice of Meeting | 2 |

Each director nominee is elected annually by a majority of votes cast. For more information about our nominees, see page 5pages 6 through 10 of this proxy statement.

| Board Committee Memberships |

| |||||||

Name | Age | Director Since | Independent | Audit | Compensation & Organization | Executive* | Finance | Governance | Other Public Company Boards |

Craig Arnold | 55 | 2015 |

|

|

|

|

|

| 1 |

Todd M. Bluedorn | 52 | 2010 | ✓ | ■ |

| ■ | ■ |

| 1 |

Christopher M. Connor | 59 | 2006 | ✓ |

| ● | ■ | ■ |

| 1 |

Michael J. Critelli | 67 | 1998 | ✓ | ■ |

| ■ |

| ■ | - |

Alexander M. Cutler | 64 | 1993 |

|

|

| ● |

|

| 2 |

Richard H. Fearon | 60 | 2015 |

|

|

|

|

|

| 1 |

Charles E. Golden | 69 | 2007 | ✓ |

| ■ | ■ | ● |

| 1 |

Linda A. Hill | 59 | 2012 | ✓ |

| ■ | ■ |

| ■ | 1 |

Arthur E. Johnson | 69 | 2009 | ✓ |

| ■ | ■ |

| ● | 2 |

Ned C. Lautenbach | 72 | 1997 | ✓ |

| ■ | ■ |

| ■ | - |

Deborah L. McCoy | 61 | 2000 | ✓ | ■ |

| ■ |

| ■ | - |

Gregory R. Page | 64 | 2003 | ✓ | ● |

| ■ |

| ■ | 2 |

Sandra Pianalto | 61 | 2014 | ✓ |

| ■ | ■ | ■ |

| 2 |

Gerald B. Smith | 65 | 2012 | ✓ | ■ |

| ■ | ■ |

| - |

* Mr. Cutler has been a member of the Executive Committee for the full 12-month term and serves as Committee Chair. | ■ Member | ● Chair |

| ||||||

| Board Committee Memberships |

| |||||||

Name | Age | Director Since | Independent | Audit | Compensation & Organization | Executive* | Finance | Governance | Other Public Company Boards |

Craig Arnold | 57 | 2015 |

|

|

|

|

|

| 1 |

Todd M. Bluedorn | 54 | 2010 | ✓ |

|

| ■ | ■ |

| 2 |

Christopher M. Connor | 61 | 2006 | ✓ |

| ■ | ■ | ■ |

| 2 |

Michael J. Critelli | 69 | 1998 | ✓ |

| ■ | ■ |

| ■ | - |

Richard H. Fearon | 62 | 2015 |

|

|

|

|

|

| 1 |

Charles E. Golden | 71 | 2007 | ✓ |

| ■ | ■ |

| ■ | 1 |

Arthur E. Johnson | 71 | 2009 | ✓ |

| ■ | ■ |

|

| 1 |

Deborah L. McCoy | 63 | 2000 | ✓ | ■ |

| ■ |

| ■ | - |

Gregory R. Page | 66 | 2003 | ✓ | ■ |

| ■ |

| ■ | 2 |

Sandra Pianalto | 63 | 2014 | ✓ | ■ |

| ■ |

|

| 3 |

Gerald B. Smith | 67 | 2012 | ✓ |

|

| ■ | ■ |

| - |

Dorothy C. Thompson | 57 | 2016 | ✓ | ■ |

| ■ | ■ |

| - |

| * Mr. Arnold was a member of the Executive Committee for all of 2017 and serves as Committee Chair. Each of the non-employee directors serves a four-month term. | ■ Member |  Chair Chair | |||||||

EATON 2016 Proxy Statement and Notice of Meeting 2

| EATON2018 Proxy Statement and Notice of Meeting | 3 |

CEO CompensationPay for Performance Culture

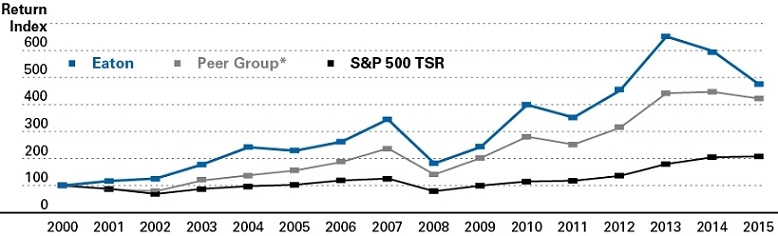

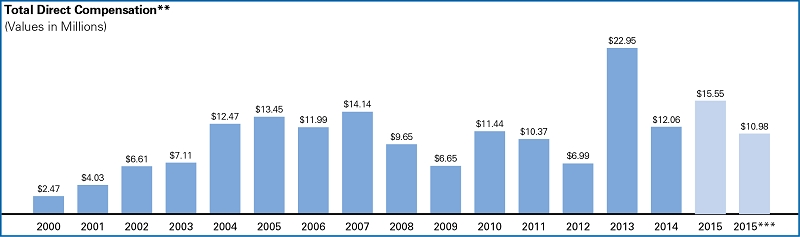

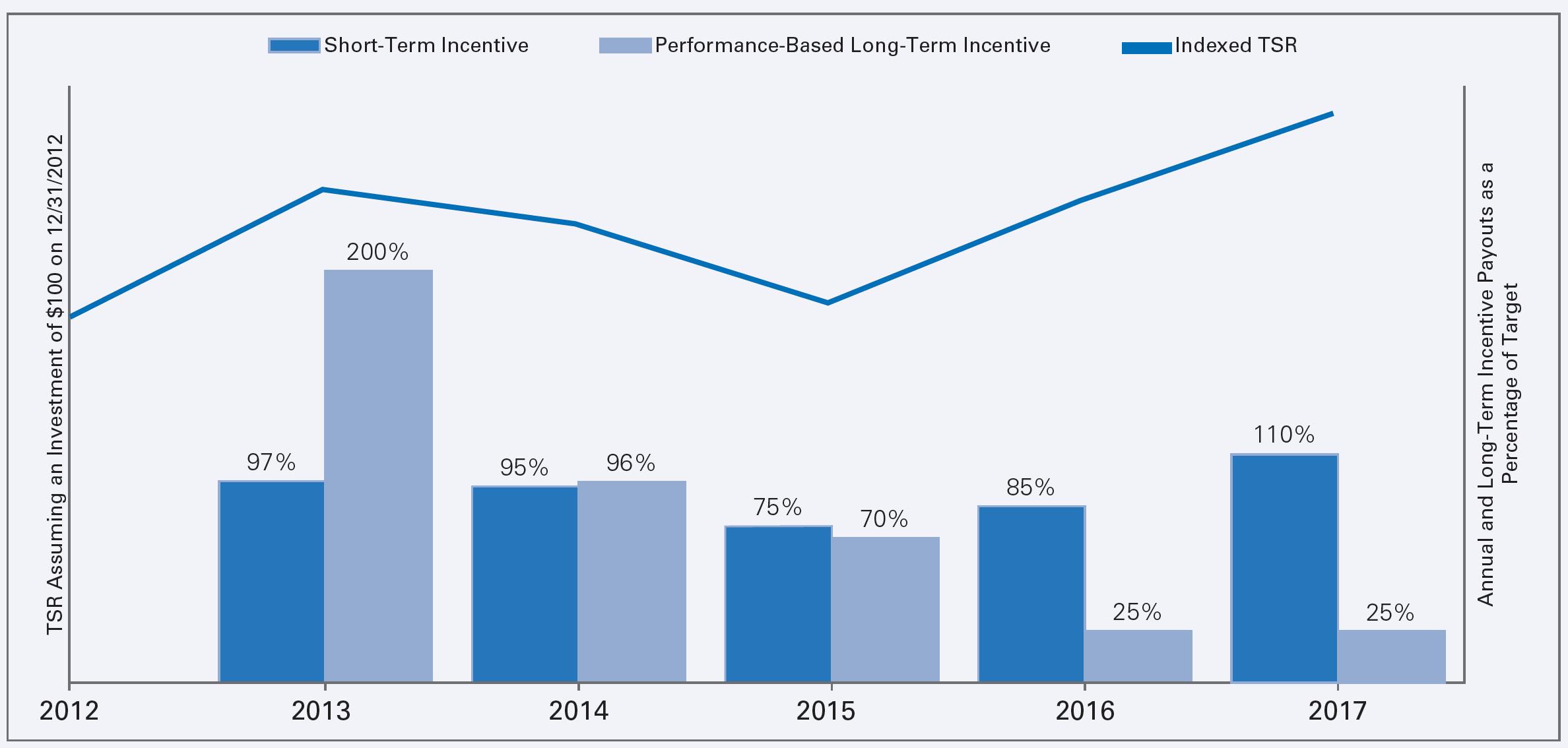

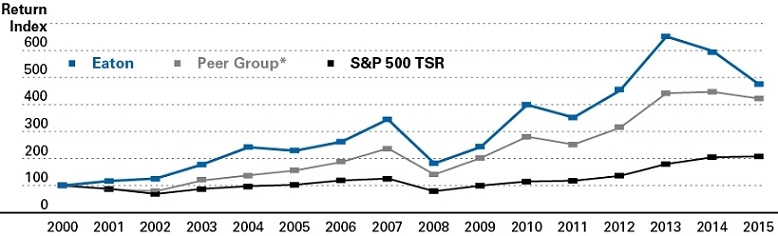

Our executive compensation programs reflect the belief that the amount earned by our executives must, to a significant extent, depend on achieving rigorous Company, business unit and Cumulative Shareholder Returns

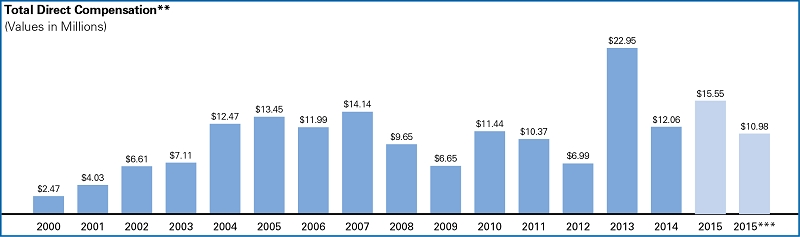

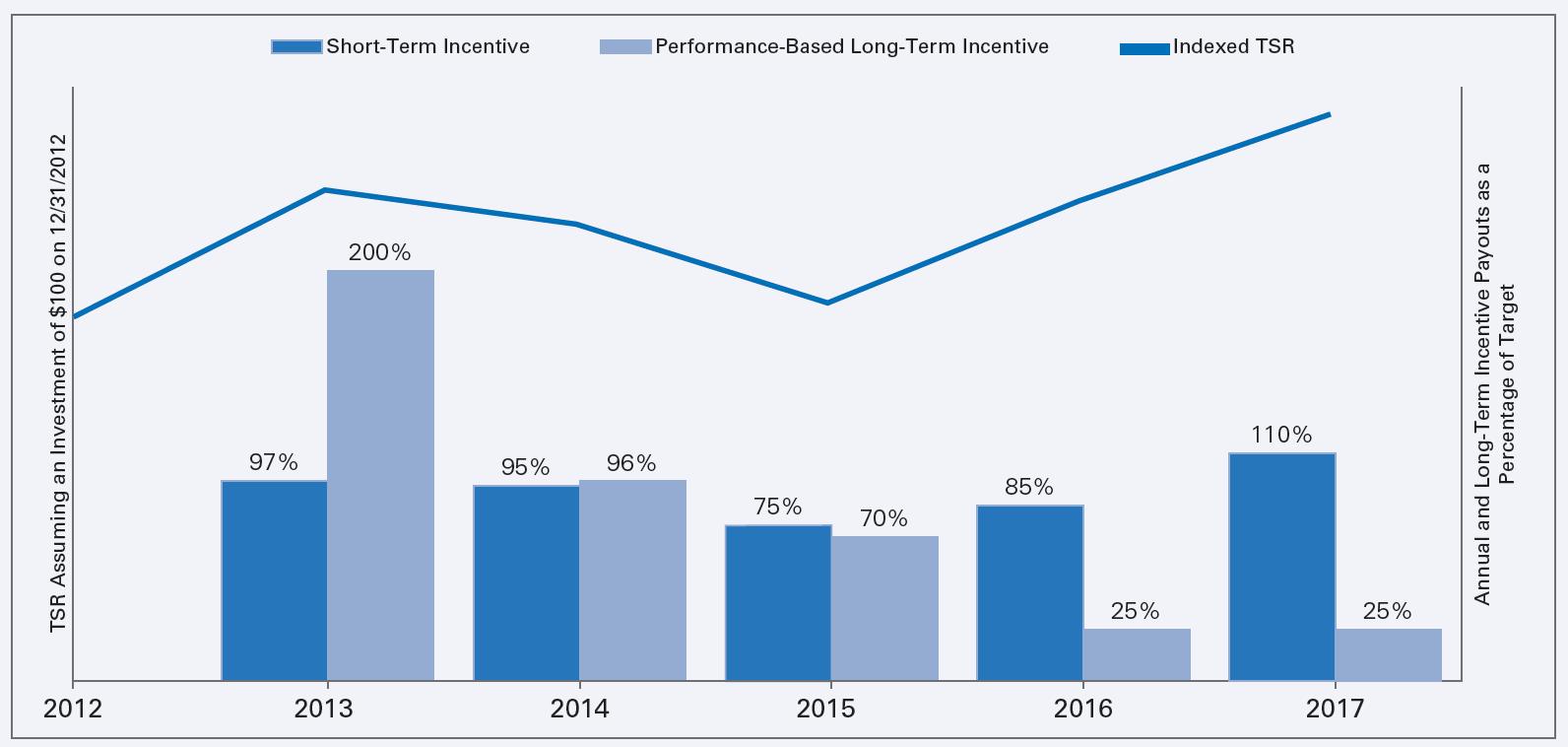

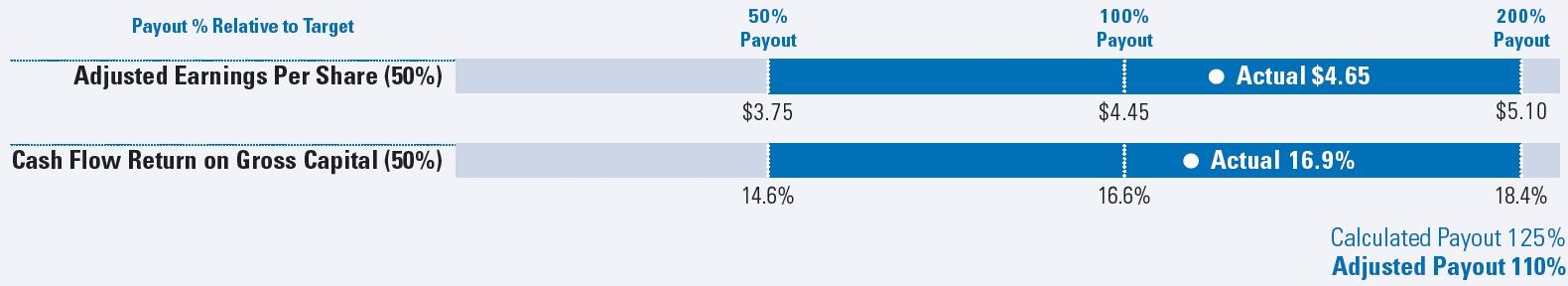

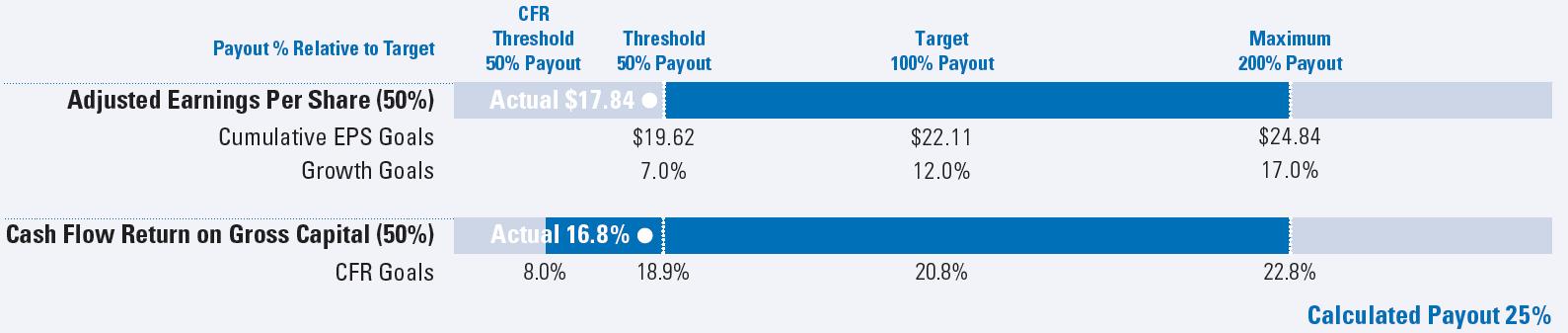

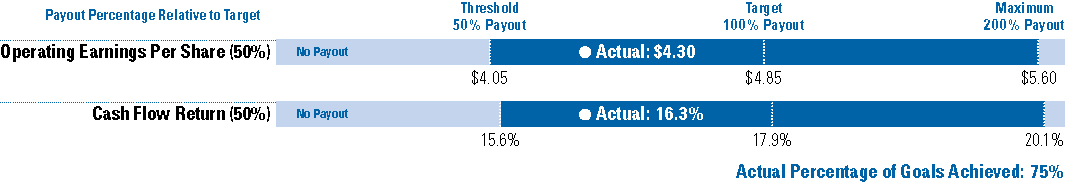

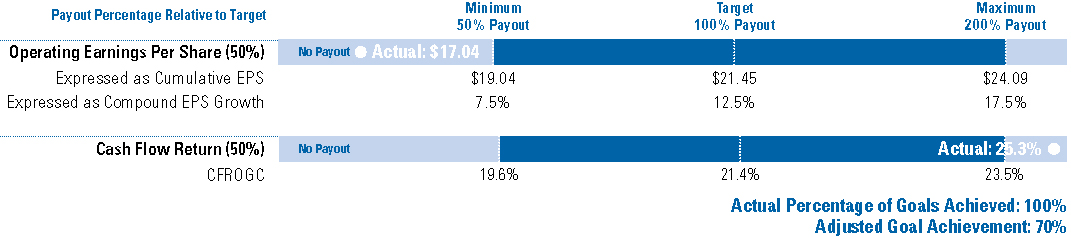

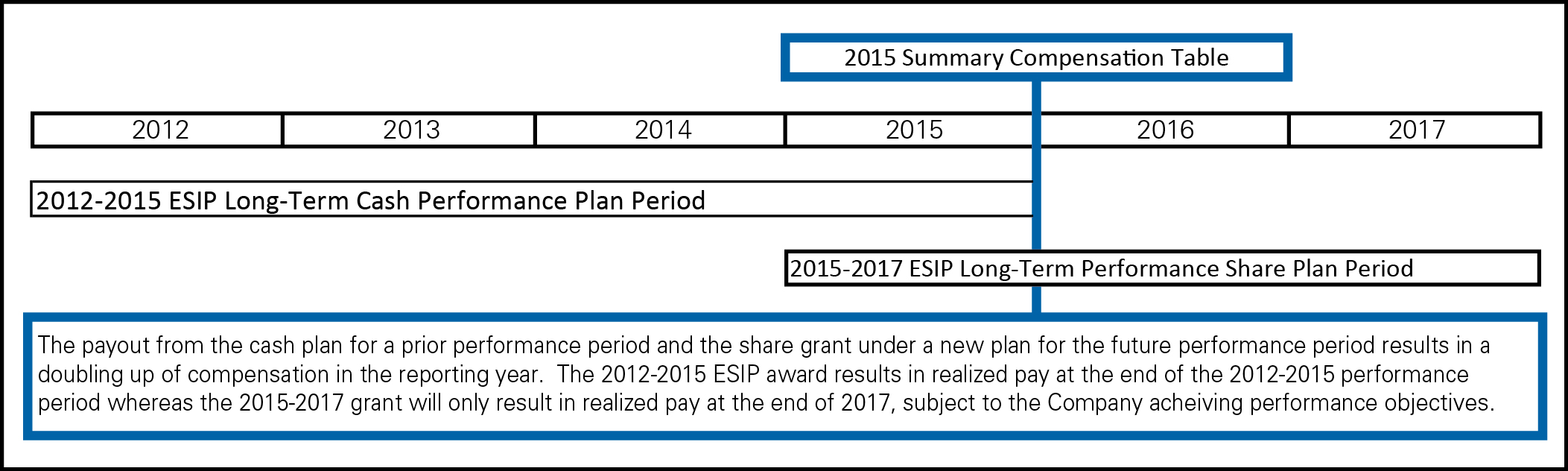

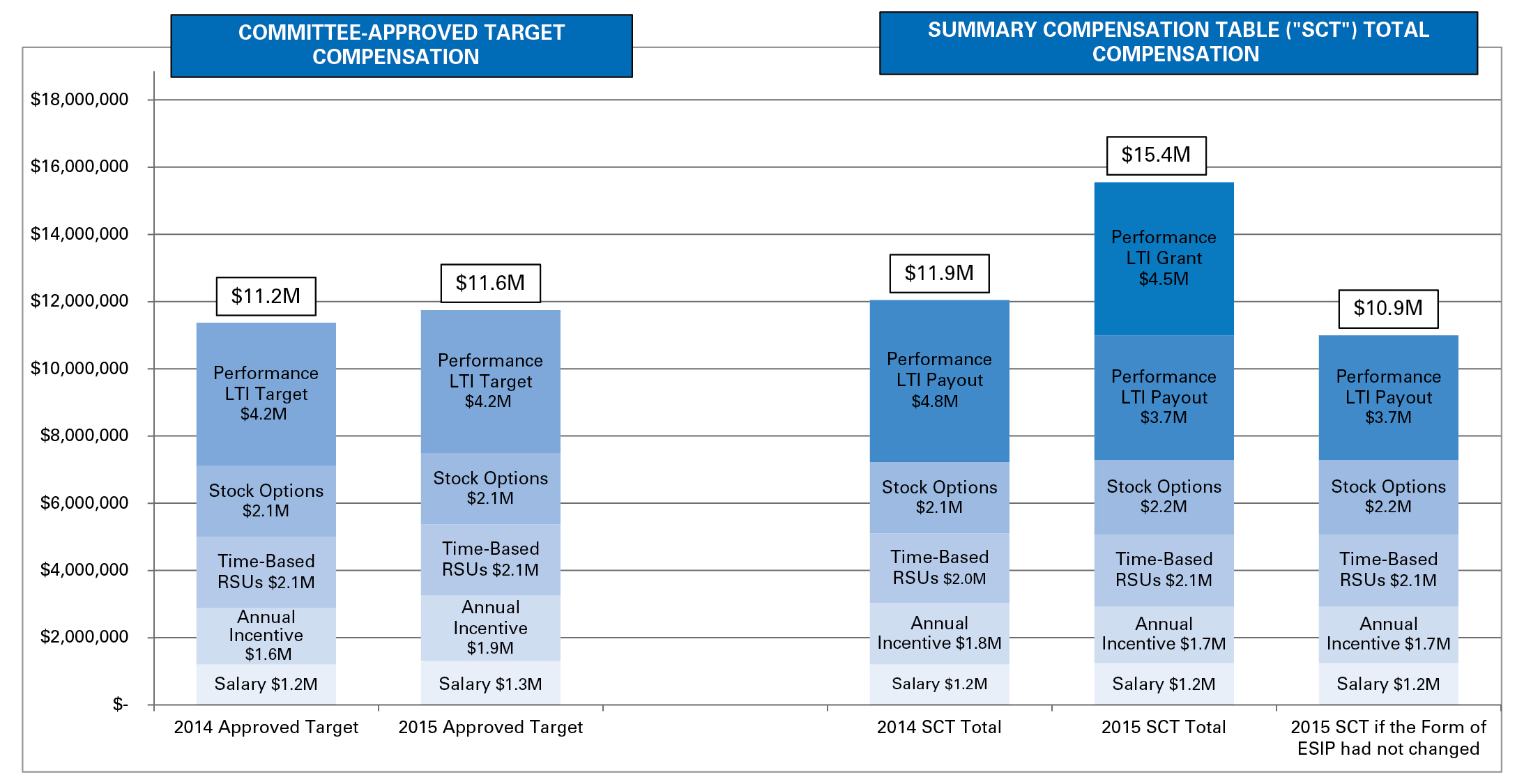

The following chart illustrates Mr. Cutler’s compensationindividual performance objectives designed to enhance shareholder value. This illustration shows the payouts as a percentage of target under our performance-based annual and cumulativelong-term incentive programs and total return to shareholders over his tenure as the Company’s Chairman and Chief Executive Officerlast five years. As described on page 25, in 2015, we changed the length of Eaton Corporation. our performance-based long-term award periods from four to three years. As a result, two long-term performance periods ended on December 31, 2017. Awards for each period were earned at 25% of target.

The table clearly illustrates the correlation between pay and the performance we are delivering to our shareholders.

CUMULATIVETOTAL SHAREHOLDER RETURNS vs. TOTAL DIRECT COMPENSATION

Cumulative Total Shareholder Returns

The peer group represents an equal weighted index of ABB, Ltd., Danaher Corporation, Dover Corporation, Emerson Electric Co., Honeywell International, Inc., Illinois Tool Works, Inc., Ingersoll-Rand plc, Legrand S.A., Parker Hannifin Corporation, Rockwell Automation, Schneider Electric SE, Siemens AG, and United Technologies Corporation.

Total direct compensation is the sum of the annual base salary, short-term incentive award earned in each respective year, performance-based long-term cash incentive (ESIP) award earned for the award period ending in each respective year, and grant date value of stock and option awards granted in each respective year. There was no payment under the ESIP plan in 2012. 2013 total compensation includes a $15.6 million payout from the 2010-2013 ESIP. This ESIP payment resulted from exceeding the maximum EPS growth and CFR goals of 30% and 15.1%, respectively, and from an increase in our stock price of 123% over the four-year period that began on January 1, 2010 and ended on December 31, 2013.

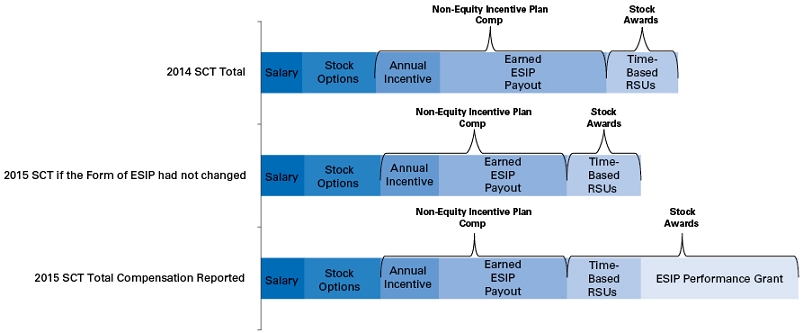

2015 total compensation includes payouts from the ESIP period that matured on December 31, 2015 and because the form of our performance-based long term incentives changed, grants for the period that began on January 1, 2015. The $10.98 million is the amount that would have been reported for 2015 if the form of ESIP had not changed. Please refer for “Adjustments to Compensation Programs For 2015” on page 33 for more information about this change.

EATON 2016 Proxy Statement and Notice of Meeting 3

| EATON2018 Proxy Statement and Notice of Meeting | 4 |

We design our executive compensation plans and programs to help us attract, motivate, reward, and retain highly qualified executives who are capable of creating and sustaining value for our shareholders over the long term. We endorse compensation actions that fairly reflect company performance as well as the responsibilities and personal performance of individual executives.

Executive Compensation Program Highlights

Our executive compensation programs are intended to align the interests of our executives with those of our stakeholders and are structured to reflect best practices. Some features of our programs are included in the following chart.

20152017 EXECUTIVE COMPENSATION PRACTICES

WhatWeDo: | WhatWeDon’tDo: | |||||

✓ | Focus on long-term compensation using a balanced portfolio of compensation elements such as cash and equity, and deliver rewards based on sustained performance over time | |||||

✓ | Stock ownership requirements for executives (6X base salary for CEO) | |||||

✓ | ||||||

Caps in our short- and long-term incentive plans, which prevent unintended windfalls ✓ Compensation recovery policy (clawbacks) ✓ Use of targeted performance metrics to align pay with performance | ✗ | No employment contracts with any salaried U.S. employees, including named executive officers ✗ No hedging or pledging of our shares ✗ No dividend or dividend equivalent payments on unearned performance-based grants ✗ No use of the same metrics in short- and long-term incentive plans | ||||

✗ | No repricing of stock options and no discounted stock options ✗ No tax gross-ups | |||||

SAY ON PAY 2015 ADVISORY VOTE AND SHAREHOLDER ENGAGEMENTSay On Pay 2017 Advisory Vote

The Board of Directors is committed to understanding the views of our shareholders by providing an opportunity to endorse our executive compensation through an advisory, non-binding vote. In 2015,2017, our shareholders approved our executives’ compensation by a vote of 93%94%.

After carefully considering these voting results and a comprehensive assessment Additionally, 90% of Eaton’sshares voted were in favor of holding the advisory vote on executive compensation programs, the Committee decided to make certain adjustments to our executive compensation programs, including changes to the form and length of our performance-based long-term incentive program. These and the other changes that were implemented in 2015 are summarized on page 33.an annual basis.

The Committee will continue to review our compensation programs each year in light of the annual “say-on-pay” voting results.

EATON 2016 Proxy Statement and Notice of Meeting 4

| EATON2018 Proxy Statement and Notice of Meeting | 5 |

Our Board of Directors is currently comprised of 1412 members, all of whom serve for a term of one year or until a respective successor is elected and has been qualified. However, Alexander M. Cutler, our Chairman, has announced his retirement from the Board in May 2016 in connection with his retirement as Eaton’s Chief Executive Officer. After Mr. Cutler’s retirement, the Board will consist of 13 members. All nominees are currently Eaton directors who were elected by shareholders at the 20152017 annual general meeting, except Craig Arnold and Richard H. Fearon, who were elected by the Board of Directors effective September 1, 2015.meeting.

If any of the nominees becomes unable or declinedeclines to serve, the individuals named as proxies in the enclosed proxy form will have the authority to vote for any substitutes who may be nominated in accordance with our Articles of Association. However, we have no reason to believe that this will occur.

Craig Arnold

Craig Arnold is Director Qualifications:Mr. Arnold’s years of senior management and executive leadership experience at Eaton provide important insight into the Company to the benefit of the Board of Directors. Mr. Arnold has gained detailed knowledge of Eaton’s businesses, customers, end markets, sales and marketing, technology innovation and new product development, supply chains, manufacturing operations, talent development, policies and internal functions through his service in a wide range of management roles with the Industrial Sector, and as President and Chief Operating Officer of the Company. Further, he possesses significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies, most notably for Medtronic plc, a publicly traded company domiciled in Ireland. |  |

DirectorSince2015 Age |

Todd M. Bluedorn Chairman and Chief Executive Officer, Lennox International Inc. Todd M. Bluedorn is Chairman and Chief Executive Officer of Lennox International Inc., a global provider of climate control solutions for heating, air conditioning and refrigeration markets. Prior to joining Lennox International in 2007, Mr. Bluedorn served in numerous senior management positions for United Technologies Corporation since 1995, including President, Americas — Otis Elevator Company; President, North America — Commercial Heating, Ventilation and Air Conditioning for Carrier Corporation; and President, Hamilton Sundstrand Industrial. He is Director Qualifications:Mr. Bluedorn has executive leadership experience in original equipment and aftermarket business and distributor/dealer-based commercial channels. He also has senior leadership experience with two major industrial corporations. His experience with industrial companies in responding to dynamic market conditions benefits Eaton as a global manufacturing company with product distribution through numerous commercial channels. |

Director Since 2010 Age

| |

| EATON2018 Proxy Statement and Notice of Meeting | 6 |

EATON 2016 Proxy Statement and Notice of Meeting 5

Christopher M. Connor Retired Chairman and Chief Executive Christopher M. Connor is the retired Chairman and Chief Executive Director Qualifications:As |

Lead Director Age

|

Michael J. Critelli Retired Chairman and Chief Executive Officer, Michael J. Critelli Director Qualifications:Mr. Critelli has extensive experience in risk management, cybersecurity, industry-wide leadership in transportation, logistics, online and social media marketing and communications issues. In addition to broad business experience gained while leading a global Fortune 500 company, he is a thought leader on transportation strategy and regulatory reform, as well as innovative approaches to healthcare. His background and experience are valuable to our Board as it oversees management’s efforts to develop and maintain talent, assess and evaluate enterprise risk management and cybersecurity issues, and navigate the regulatory environment. |

Director since 1998 Age |

|

|

EATON 2016 Proxy Statement and Notice of Meeting 6

Richard H. Fearon Vice Chairman and Chief Financial and Planning Officer, Eaton Corporation Richard H. Fearon has served as Chief Financial and Planning Officer of Eaton since April 2002 and Vice Chairman since January 2009. He is responsible for the accounting, control, corporate development, information systems, internal audit, investor relations, strategic planning, tax and treasury functions of Eaton. Prior to Eaton, Mr. Fearon worked at several large diversified companies, including Transamerica Corporation, NatSteel Limited and The Walt Disney Company. He currently is the lead director for PolyOne Director Qualifications: Mr. Fearon’s years of experience as |

|

Director since 2015 Age |

| EATON2018 Proxy Statement and Notice of Meeting | 7 |

Charles E. Golden Retired Executive Vice President and Chief Financial Officer, Eli Lilly and Company Charles E. Golden served as Executive Vice President and Chief Financial Officer and a director of Eli Lilly and Company, an international developer, manufacturer and seller of pharmaceutical products, from 1996 until his retirement in 2006. Prior to joining Eli Lilly, he had been associated with General Motors Corporation since 1970, where he held a number of positions, including Corporate Vice President, Chairman and Managing Director of the Vauxhall Motors subsidiary and Corporate Treasurer. He is currently on the board of Hill-Rom Holdings, Inc. and was a past director of Unilever NV/PLC. Director Qualifications:Mr. Golden has a comprehensive knowledge of both U.S. and international financial accounting standards. He has extensive experience in financial statement preparation, accounting, corporate finance, risk management and investor relations both in the U.S. and internationally. His broad financial expertise enables him to provide expert guidance and oversight |

Director since 2007 Age |

|

|

|

EATON 2016 Proxy Statement and Notice of Meeting 7

Arthur E. Johnson Retired Senior Vice President, Corporate Strategic Development, Lockheed Martin Corporation

Arthur E. Johnson is the retired Senior Vice President, Corporate Strategic Development of Lockheed Martin Corporation, a manufacturer of advanced technology systems, products and services. Mr. Johnson was elected a Vice President of Lockheed Martin Corporation and named President of Lockheed Martin Federal Systems in 1996. He was named President and Chief Operating Officer of Lockheed Martin’s Information and Services Sector in 1997 and Senior Vice President, Corporate Strategic Development in 1999. Mr. Johnson currently is a director of Booz Allen Hamilton and during the past five years was a director of AGL Resources, Inc. Director Qualifications:Mr. Johnson’s role in strategic development with a leading company in the defense industry has given him an understanding of doing business with governments, strategic planning, regulatory compliance, and legislative and public policy matters. His knowledge of the global aerospace and defense industry are of particular benefit to our Board in connection with these businesses. Mr. Johnson’s service as lead director of a New York Stock Exchange listed company, as well as his service on other boards, provides Eaton with valuable corporate governance expertise, which is of particular benefit to Eaton in his role as Chair of the Governance Committee. |

|

Director since 2009 Age

|

|

|

Deborah L. McCoy Independent aviation safety consultant

Deborah L. McCoy is an independent aviation safety consultant. She retired from Continental Airlines, Inc. in 2005, where she had served as Senior Vice President, Flight Operations since 1999. During part of 2005, Ms. McCoy also briefly served as the Chief Executive Officer of DJ Air Group, a start-up commercial airline company.

Director Qualifications:Ms. McCoy has extensive experience in the commercial aerospace markets and brings an understanding of aircraft design and performance, global airline operations and the strategic issues and direction of the aerospace industry. In addition, Ms. McCoy has extensive experience in safety initiatives, Federal regulatory compliance, labor relations, talent management, and risk analysis and mitigation. All of these attributes are of benefit to Eaton’s Board in its oversight role across the enterprise. |

|

Director since 2000 Age

|

EATON 2016 Proxy Statement and Notice of Meeting 8

| EATON2018 Proxy Statement and Notice of Meeting | 8 |

Gregory R. Page Retired Chairman and Chief Executive

Gregory R. Page is the retired Chairman and Chief Executive

Director Qualifications: As |

|

Director since 2003 Age |

Sandra Pianalto Retired President and Chief Executive Officer of the Federal Reserve Bank of Cleveland

Sandra Pianalto served as President and Chief Executive Officer of the Federal Reserve Bank of Cleveland from February 2003 until her retirement in June 2014. She joined the Bank in 1983 as an economist in the research

Director Qualifications:Ms. Pianalto has extensive experience in monetary policy and financial services, and brings to Eaton wide-ranging leadership and operating skills through her former roles with the Federal Reserve Bank of Cleveland. As Chief Executive Officer of the Bank, she developed expertise in economic research, management of financial institutions, and payment services to banks and the U.S. Treasury. Ms. Pianalto’s comprehensive experience qualifies her to provide substantial guidance and oversight to the Board |

|

Director since 2014 Age

|

| EATON2018 Proxy Statement and Notice of Meeting | 9 |

EATON 2016 Proxy Statement and Notice of Meeting 9

Gerald B. Smith Chairman and Chief Executive Officer, Smith Graham & Co., and former lead independent director of Cooper Industries plc

Gerald B. Smith was a director of Cooper Industries plc from 2000 until 2012 and served as lead independent director of Cooper Industries plc since 2007. Mr. Smith joined the Board effective upon the close of the Cooper acquisition. He is Chairman and Chief Executive Officer of Smith Graham & Co., an investment management firm that he founded in 1990. Prior to launching Smith Graham, he served as Senior Vice President and Director of Fixed Income for Underwood Neuhaus & Company. He is a member of the Board of Trustees and chair of the Investment Oversight Committee for The Charles Schwab Family of Funds. Mr. Smith also serves as a director and chair of the Investment Committee of the New York Life Insurance Company. In the past five years, Mr. Smith was a director of ONEOK Inc. and ONEOK Partners MLP. He serves as Chairman of the Texas Southern University Foundation and a director of the Federal Reserve Bank of Dallas. He is a former director of the Federal Reserve Bank of Dallas, Houston

Director Qualifications: Mr. Smith has expertise in finance, portfolio management and marketing through executive positions in the financial services industry, including being founder, Chairman and |

Director since 2012 Age

| |

Dorothy C. Thompson Retired Chief Executive, Drax Group Dorothy C. Thompson CBE is the retired Chief Executive and director of Drax Group plc, a U.K.-based power retail and generation company. She was appointed CEO of Drax Group plc in September 2005 and to the company’s Board of Directors in October 2005. Prior to joining Drax, Ms. Thompson was vice president of InterGen NV, an independent power-company jointly owned by Shell and Bechtel. She joined InterGen in 1998 from PowerGen plc where she was assistant group treasurer. In addition to her leadership at Drax, she is a member of the Board of Directors of the Court of the Bank of England and was a director of Johnson Matthey Plc until 2016. Director Qualifications: As the retired Chief Executive of Drax, Ms. Thompson has unique insight into the sourcing, generation and supply of sustainable and renewable energy. She also brings to the Board vast experience in all aspects of finance as well as an international business perspective. |

Director since 2016 Age 57 | |

| EATON2018 Proxy Statement and Notice of Meeting | 10 |

The Governance Committee of the Board, composed entirely of directors who meet the independence standards of

the Board of Directors and the New York Stock Exchange, is responsible for overseeing the process of nominating individuals to stand for election as directors. The Governance Committee charter is available on our website at http://www.eaton.com/governance.

The Governance Committee will consider any director candidates recommended by our shareholders, consistent with the process used for all candidates. To learn how to submit a shareholder recommendation, see below under “Shareholder Recommendations of Director Candidates.”

The Governance Committee chair reviews all potential director candidates in consultation with the Chairman, typically with the assistance of a professional search firm retained by the Committee. The Committee decides whether to recommend one or more candidates to the Board of Directors for nomination. Candidates who are ultimately nominated by the Board stand for election by the shareholders at the annual general meeting. Between annual general meetings, nominees may also be elected by the Board itself. Directors Craig Arnold and Richard H. Fearon were elected by the Board effective September 1, 2015. Messrs. Arnold and Fearon were identified as director candidates by the Chairman and other Company directors as part of the Company’s succession planning.

Director Qualifications and Board Diversity

The Board of Directors recognizes the value of nominating director candidates who bring diverse opinions, perspectives, skills, experiences, backgrounds, and orientations to Board deliberations. The Governance Committee uses a rigorous process for identifying and evaluating director nominees. In order to be recommended by the Governance Committee, a candidate must have the following minimum qualifications, as described in the Board of Directors Governance Policies: personal ability, integrity, intelligence, relevant business background, independence, expertise in areas of importance to our objectives, and a commitment to our corporate mission. In addition, the Governance Committee looks for individuals with specific qualifications so that the Board as a whole has diversity in experience, international perspective, background, expertise, skills, age, gender, and ethnicity. These specific qualifications may vary from year to year, depending upon the composition of the Board at that time.

EATON 2016 Proxy Statement and Notice of Meeting 10

The Governance Committee is responsible for ensuring that director qualifications are met and Board balance and diversity objectives are considered during its review of director candidates. The Committee annually evaluates the extent to which these goals are satisfied as part of its yearly assessment of the skills and experience of each of the current directors using a director skills matrix and a director evaluation process.

The director evaluation process includes self-evaluation, peer evaluationinput from the Chairman and CEO, and input from the chairs of each Board committee. A self-evaluation is designed to elicit each director’s thoughts about his or her contibutions in light of the needs of the Board and the Company. The evaluation is focused on opportunities for further improvement in effectiveness, indication of preferences in future Board committee rotation, identification of board matter educational priorities, and requests for Company specific orientation information. The director evaluation process is typically conducted during the October and February Governance Committee and Board meetings. At the conclusion of the evaluation process, the Chair of the Governance Committee provides specific feedback to the individual directors relative to further performance improvement, educational opportunities, and other counsel.

Upon completion of the skills matrix and the evaluation process, the Governance Committee identifies areas of director knowledge and experience that may benefit the Board in the future and uses that information as part of the director search and nomination effort.

The Board of Directors Governance Policies are available on our website at http://www.eaton.com/governance.

| EATON2018 Proxy Statement and Notice of Meeting | 11 |

Shareholder Recommendations of Director Candidates

The Governance Committee will consider director candidates who are recommended to it in writing by any Eaton shareholder. In accordance withshareholder who submits a recommendation by following the procedures required under our Articles of Association for nominating director candidates. Accordingly, any shareholder wishing to recommend an individual as a nominee for election at the 20172019 annual general meeting of shareholders should send a signed letter of recommendation to the following address: Eaton Corporation plc, Attention: Company Secretary, Eaton House, 30 Pembroke Road, Dublin 4, Ireland.Ireland D04 Y0C2. Recommendation letters must be received no earlier than December 18, 2016November 16, 2018 and no later than the close of business on January 17, 2017December 16, 2018, and must include the reasons for the recommendation, the full name and address of each proposed nominee, and a brief biographical history setting forth past and present directorships, past and present positions held, occupations and civic activities. The recommendation letter should be accompanied by a written statement from the proposed nominee consenting to be nominated and, if nominated and elected, to serve as a director.

Any shareholder wishing to recommend an individual as a nominee for election as a director must also describe in a detailed writing any financial agreement, arrangement or understanding between the nominee and any party other than the Company relating to such nominee’s potential service as a director, and details of any compensation or other payment received from any such third party other than the Company relating to such nominee’s potential service as a director, and details regarding such agreement, arrangement or understanding and its terms, or of any compensation received.director.

The Board of Directors Governance Policies provide that all of our non-employee directors should be independent. The listing standards of the New York Stock Exchange state that no director can qualify as independent unless the Board of Directors affirmatively determines that he or she has no material relationship with the Company. Additional, and more stringent, standards of independence are required of Audit Committee members. Our annual proxy statement discloses the Board’s determination as to the independence of the Audit Committee members and of all non-employee directors. For our current directors, we describe these determinations here.

As permitted by the New York Stock Exchange listing standards, the Board of Directors has determined that certain categories of relationships between a non-employee director and the Company will be treated as immaterial for purposes of determining a director’s independence. These “categorical” standards are included in the Board of Directors’ independence criteria. The independence criteria for non-employee directors and members of the Audit Committee are available on our website at http://www.eaton.com/governance.

Because directors’director independence may be influenced by their use of Company aircraft and other Company-paid transportation, the Board has adopted a policy on this subject.

In their review of director independence, the Board of Directors and its Governance Committee have considered the following circumstances:

Directors T. M. Bluedorn, C. M. Connor, L. A. Hill and G. R. Page currently serve or have served as officers or employees of companies that had purchases and/or sales of property or services with us during 2015.2017. In each case, the amounts of the purchases and sales met the Board’s categorical standard for immateriality; that is, they were less than the greater of $1 million or 2% of the annual consolidated gross revenues of the director’s company. Mr. Bluedorn is Chairman and CEO of Lennox International Inc., which purchased approximately $373,000$360,000 worth of Eaton products and sold approximately $38,000 worth of products to Eaton during 2015.2017. Mr. Connor is the retired Chairman and Chief Executive ChairmanOfficer of The Sherwin-Williams Company, which purchased approximately $47,000$97,000 worth of Eaton products and sold approximately $476,000$838,000 worth of products to Eaton during 2015. Ms. Hill is a director of Harvard Business Publishing, which provided executive training services to Eaton for an aggregate cost of $286,000

EATON 2016 Proxy Statement and Notice of Meeting 11

during 2015.2017. Mr. Page is the retired Chairman and Chief Executive DirectorOfficer of Cargill, Incorporated, which purchased approximately $833,000$878,000 worth of Eaton products and sold approximately $17,633,000$17,982,000 worth of products to Eaton during 2015.2017. In addition, Cargill paid approximately $7,558,000$608,000 in royalty payments to the Company.

The use of our aircraft and other Company-paid transportation by all non-employee directors is consistent with the Board policy on that subject.

After reviewing the circumstances described above (which are the only relevant circumstances known to the Board of Directors), the Board has affirmatively determined that none of our non-employee directors has a material relationship with the Company other than in his or her capacity as a director, and that eachall of the followingour non-employee directors qualifiesqualify as independent under the Board’s independence criteria and the New York Stock Exchange standards: T. M. Bluedorn, C. M. Connor, M. J. Critelli, C. E. Golden, L. A. Hill, A. E. Johnson, N. C. Lautenbach, D. L. McCoy, G. R. Page, S. Pianalto and G. B. Smith.standards. All members of the

| EATON2018 Proxy Statement and Notice of Meeting | 12 |

Audit, Compensation and Organization, Finance, and Governance Committees qualify as independent under the standards described above.

The Board also has affirmatively determined that each member of the Audit Committee that is, T. M. Bluedorn, M. J. Critelli,— D. L. McCoy, S. Pianalto, G. R. Page, G. Smith and G. B. Smith,D. Thompson — meets not only our Board’s independence criteria but the special independence standards required by the New York Stock Exchange and the Sarbanes-Oxley Act of 2002 and the related rules adopted by the Securities and Exchange Commission.

Review of Related Person Transactions

Our Board of Directors has adopted a written policy to identify and evaluate “related person transactions,” that is, transactions between us and any of our executive officers, directors, director nominees, 5%-plus security holders or members of their “immediate families,” or organizations where they or their family members serve as officers or employees. The Board policy calls for the disinterested members of the Board’s Governance Committee to conduct an annual review of all such transactions. At the Committee’s direction, a survey is conducted annually of all transactions involving related persons, and the Committee reviews the results in January or February of each year. The Committee is responsible for determining whether any “related person transaction” (i) poses a significant risk of impairing, or appearing to impair, the judgment or objectivity of the individuals involved; (ii) poses a significant risk of impairing, or appearing to impair, the independence of an outside director or director nominee; or (iii) has terms that are less favorable to us than those generally available in the marketplace. Depending upon the Committee’s assessment of these risks, the Committee will respond appropriately. In addition, as required by the rules of the Securities and Exchange Commission, any transactions that are material to a related person are disclosed in our proxy statement.

As discussed above, the Governance Committee is charged with reviewing issues involving director independence and all related persons transactions. The Committee and the Board have determined that since the beginning of 20152017 the only related person transactions were those described above under the heading “Director Independence” and that none of our executive officers engaged in any such transactions. The Committee also concluded that none of the related person transactions posed risks to the Company in any of the areas described above.

EATON 2016 Proxy Statement and Notice of Meeting 12

| EATON2018 Proxy Statement and Notice of Meeting | 13 |

The Board of Directors has the following standing committees: Audit, Compensation and Organization, Executive, Finance, and Governance.

| Audit Committee | Met | ||||

| The functions of the Audit Committee include assisting the Board in overseeing: | ||||

■the integrity of our financial statements and its systems of internal accounting and financial controls; ■ the independence, qualifications and performance of our independent auditor; | ■the performance of our internal auditors; ■ the cybersecurity program as part of the risk oversight function; and ■ our compliance with legal and regulatory requirements. | ||||

The Committee also has sole authority to appoint, compensate and terminate the independent auditor, and pre-approves all auditing services and permitted non-audit services that the audit firm may perform for the Company. The Committee is also responsible for negotiating the audit fees. In order to ensure continuing auditor independence, the Committee periodically considers whether there should be a rotation of the independent audit firm. In conjunction with the mandated rotation of the audit firm’s lead engagement partner, the Committee and its Chair are directly involved in the selection of the audit firm’s new lead engagement partner. Among its other responsibilities, the Committee meets regularly in separate Executive Sessions with our independent auditor and senior leaders of Eaton Corporation, including the Vice Chairman and Chief Financial and Planning Officer, Executive Vice President and General Counsel, Each Committee member meets the independence requirements, and all Committee members collectively meet the other requirements, of the New York Stock Exchange, the Sarbanes-Oxley Act of 2002 and the Securities and Exchange Commission. In addition, Committee members are prohibited from serving on more than two other public company audit committees. The Board of Directors has determined that each member of the Audit Committee is financially literate, that Messrs. | |||||

EATON 2016 Proxy Statement and Notice of Meeting 13

| EATON2018 Proxy Statement and Notice of Meeting | 14 |

| Compensation and Organization Committee | Met | ||||

Todd M. Bluedorn Christopher M. Connor | The functions of the Compensation and Organization Committee include: | ||||

■reviewing proposed organization or responsibility changes at the senior officer level; ■ evaluating the performance of the Company’s Chairman and Eaton Corporation’s Chief Executive Officer with input from all non-employee directors; ■ reviewing the performance evaluations of the other senior officers; ■ reviewing succession ■ reviewing our practices for recruiting and developing a diverse talent pool; ■ determining the annual salaries and short-and long-term incentive opportunities for our senior officers; ■ establishing performance objectives under our | ■annually determining the aggregate amount of awards to be made under our short-term incentive compensation plans and adjusting those amounts as it deems appropriate within the terms of those plans; ■ annually determining the individual awards to be made to our senior officers under our short- and long-term incentive compensation plans; ■

■ reviewing compensation practices as they relate to key employees to confirm that those plans remain equitable and competitive; ■ reviewing significant new employee benefit plans or significant changes in such plans or changes with a disproportionate effect on our officers or primarily benefiting key employees; and ■

| ||||

| Additional information on the Committee’s processes and procedures is contained in the Compensation Discussion and Analysis portion of this proxy statement beginning on page | |||||

| 23. | ||||

| Executive Committee | |||||

Each non-employee director serves a four-month term | The functions of the Executive Committee include: | ||||

| ■acting on matters requiring Board action during the intervals between Board meetings; and | ■carrying out any function of the Board except for filling Board or Committee vacancies. | ||||

| Mr. | |||||

| Finance Committee | Met 2 times in | ||||

Todd M. Bluedorn | The functions of the Finance Committee include: | ||||

■the periodic review of our financial condition and the recommendation of financial policies to the Board; ■ analyzing Company policy regarding its debt-to-equity relationship; ■ reviewing and making recommendations to the Board regarding our dividend policy; ■ reviewing our cash flow, proposals for long- and short-term debt financing and the financial risk management program; | ■meeting with and reviewing the performance of the management pension committees and any other fiduciaries appointed by the Board for pension and profit-sharing retirement plans; and ■ reviewing the key assumptions used to calculate annual pension expense. | ||||

| EATON2018 Proxy Statement and Notice of Meeting | 15 |

EATON 2016 Proxy Statement and Notice of Meeting 14

| Governance Committee | Met 3 times in | ||||

Arthur E. Johnson

| The responsibilities of the Governance Committee include: | ||||

■ recommending to the Board improvements in our corporate governance processes and any changes in the Board Governance Policies; ■ advising the Board on changes in the size and composition of the Board; ■

annually submitting to the Board candidates for members and chairs of each standing Board committee; ■ in consultation with the Chief Executive Officer of Eaton Corporation, identifying and recommending to the Board candidates for Board membership; | ■reviewing and recommending to the Board the nomination of directors for re-election; ■ overseeing the orientation of new directors and the ongoing education of the Board; ■ recommending to the Board compensation of non-employee directors; ■ administering the Board’s policy on director retirements and resignations; and ■ establishing guidelines and procedures to be used by the directors to evaluate the Board’s performance. | ||||

| Other responsibilities include providing oversight on significant public policy issues with respect to our relationships with shareholders, employees, customers, competitors, suppliers and the communities in which we operate, including such areas as ethics, compliance, environmental, health and safety issues, community relations, government relations, charitable contributions and shareholder relations. | |||||

Committee Charters and Policies

The Board committee charters are available on our website at http://www.eaton.com/governance.

In addition to the Board of Directors Governance Policies, certain other policies relating to corporate governance matters are adopted from time to time by Board committees, or by the Board itself upon recommendation of the committees.

BOARD MEETINGS AND ATTENDANCE AT ANNUAL GENERAL MEETING

The Board of Directors held fivefour meetings in 2015.2017. Each of the directors attended at least 85%90% of the meetings of the Board and the committees on which he or she served. The average rate of attendance for all directors was 95%.

Director Attendance at Annual General Meeting of Shareholders — The policy of the Board of Directors is that all directors should attend the annual general meetings of shareholders. At the 20152017 annual general meeting held April 22, 2015, 11 of the 1226, 2017, all members of the Board at that time were in attendance.

The Board revised the Board of Directors Governance Policies most recently in July 2015,October 2017, as recommended by the Governance Committee of the Board. The revised Governance Policies are available on our website at http://www.eaton.com/governance.

EXECUTIVE SESSIONS OF THE NON-EMPLOYEE DIRECTORS

The Board’s policy is that the non-employee directors, all of whom qualify as “independent” under the criteria of the Board of Directors and the New York Stock Exchange, meet in Executive Session at each regular Board meeting, without the Chairman or other members of management present, to discuss topics they deem appropriate. As described more fully in “Leadership Structure” below, the Lead Director chairs these Executive Sessions.

EATON 2016 Proxy Statement and Notice of Meeting 15

At each meeting of the Audit, Compensation and Organization, Finance, and Governance Committees, the Committee members (all of whom qualify as independent) hold an Executive Session, without any members of our management present, to discuss topics they deem appropriate.

| EATON2018 Proxy Statement and Notice of Meeting | 16 |

Our governance structure follows a successful leadership model under which the Chief Executive Officer of Eaton Corporation also serves as Chairman of the Board of the Company. Recognizing that different leadership models may work well for other companies at different times depending upon individual circumstances, we believe that our Company has been well served by the combined Chief Executive Officer and Chairman leadership structure and that this approach has continued to be highly effective with the addition of a Lead Director. We believe we have benefited greatly from having a Chairman who sets the tone and direction for the Company while also having the primary responsibility as Chief Executive Officer for managing Eaton'sEaton’s day-to-day operations, and allowing the Board to carry out its strategic, governance, oversight and decision-making responsibilities with the equal involvement of each director.

Our Board is composed primarily of independent directors, except for our Chairman, Mr. Cutler,Arnold, and Messrs. Arnold andMr. Fearon. Of our 1110 non-employee directors, fourfive are currently serving or have served as a chief executive officer of a publicly traded company. The Audit, Compensation and Organization, Finance, and Governance Committees are chaired by independent directors. Our Chairman has benefited from the extensive leadership experience represented on our Board of Directors.

The Board evaluates the leadership structure annually, and it will continue to do so as circumstances change, including when a new Chief Executive Officer is elected. In its February 20162018 annual evaluation, the Board concluded that the current leadership structure — under which the Chief Executive Officer of Eaton Corporation serves as Chairman of the Board of the Company, our Board committees are chaired by independent directors, and a Lead Director assumes specific responsibilities on behalf of the independent directors — remains the optimal board leadership structure for our Company and our shareholders at the present time.

Ned C. Lautenbach,Christopher M. Connor, who has served on Eaton’s Board since 1997,2006, was first elected Lead Director by our independent directors in 2010.2016. The Lead Director has specific responsibilities, including chairing meetings of the Board at which the Chairman is not present (including Executive Sessions of the Board), approving the agenda and schedule for Board meetings on behalf of the independent directors, approving information sent to the Board, serving as liaison between the Chairman and the independent directors, and being available for consultation and direct communications with shareholders and other Company stakeholders. The Lead Director has the authority to call meetings of the independent directors and to retain outside advisors who report directly to the Board of Directors. The Lead Director’s performance is assessed annually by the Board in a process led by the Chair of the Governance Committee, and the position of Lead Director is elected annually by our independent directors.

Management continually monitors the material risks facing the Company, including strategic risk, financial risk, operational risk, and legal and compliance risk. The Board of Directors has chosen to retain overall responsibility for risk assessment and oversight at the Board level in light of the interrelated nature of the elements of risk, rather than delegating this responsibility to a Board committee. The Board is responsible for overseeing the strategic planning process and reviewing and monitoring management’s execution of the corporate and business plan. As described below, the Board receives assistance from certain of its committees for the identification and monitoring of those risks that are related to the committees’ areas of focus as described in each committee charter. The Board and its committees exercise their risk oversight function by carefully evaluating the reports they receive from management and by making inquiries of management with respect to areas of particular interest to the Board.

EATON 2016 Proxy Statement and Notice of Meeting 16

The Audit Committee considers risks related to internal controls, disclosure, financial reporting and legal and compliance matters. Among other processes, the Audit Committee meets regularly in closed-door sessions with our internal and external auditors and senior leaders of Eaton Corporation, including the senior members of the Finance function, the Executive Vice President and General Counsel, and Secretary, and the Senior Vice President-Global Ethics and Compliance. As described more fully in the section entitled “Relationship Between Compensation Plans and Risk” on page 49,42, the Compensation and Organization Committee reviews risks associated with the Company’s compensation programs to ensure that incentive compensation arrangements for senior executives do not encourage inappropriate risk taking. The Governance Committee considers risks related to corporate governance, such as director independence and related person transactions, and risks associated with the environment, health and safety.

| EATON2018 Proxy Statement and Notice of Meeting | 17 |

We have a Code of Ethics that was approved by the Board of Directors. We provide training globally for all employees on our Code of Ethics. We require that all directors, officers and employees of the Company, our subsidiaries and affiliates, abide by our Code of Ethics, which is available on our website at http://www.eaton.com/governance. In addition, we will disclose on our website any waiver of or amendment to our Code of Ethics requiring disclosure under applicable rules.

The Board of Directors provides a process for shareholders and other interested parties to send communications to the Board, individual directors or the non-employee directors as a group. Shareholders and other interested parties may send such communications by mail or courier delivery addressed as follows:

Company Secretary

Eaton Corporation plc

Eaton House

30 Pembroke Road

Dublin 4, Ireland

D04 Y0C2

Email messages to the directors may be sent to Board@eaton.com.

In general,Generally, the Company Secretary forwards all such communications to the Lead Director. The Lead Director in turn determines whether the communications should be forwarded to other members of the Board and if so, forwards them accordingly. However, forFor communications addressed to a particular member of the Board, the Chair of a particular Board committee or the non-employee directors as a group, the Company Secretary forwards those communications directly to those individuals.

Alternatively, correspondence may be sent to:

Lead Director

Eaton Corporation plc

Eaton House

30 Pembroke Road

Dublin 4, Ireland

D04 Y0C2

The Secretary maintains a log of all correspondence addressed to the Board and, except as noted below, forwards all communications to the interested directors. For example, correspondence on a financial topic would be sent to the Chair of the Finance or Audit Committees, and correspondence on governance topics to the Lead Director or Chair of the Governance Committee.

The Secretary makes periodic reports to the Governance Committee regarding correspondence from shareholders and other interested parties. Because most correspondence is received shortly before or after our Annual General Meeting of Shareholders that is generally held in April, the report is typically made at the July Governance Committee meeting.

EATON 2016 Proxy Statement and Notice of Meeting 17

Derivative shareholder communications and demands for inspection of company records should be sent to the Secretary who will promptly disseminate such communications to the entire Board. The Board will consult with the General Counsel or his designee to determine appropriate action.

The directors have requested that communications that do not directly relate to their duties and responsibilities as our directors be excluded from distribution and deleted from email that they access directly. Such excluded items include “spam,” advertisements, mass mailings, form letters and email campaigns that involve unduly large numbers of similar communications, solicitations for goods, services, employment or contributions, surveys and individual product inquiries or complaints. Additionally, communications that appear to be unduly hostile, intimidating, threatening, illegal or similarly inappropriate will be screened for omission. Any omitted or deleted communications will be made available to any director upon request.

EATON 2016 Proxy Statement and Notice of Meeting 18

| EATON2018 Proxy Statement and Notice of Meeting | 18 |

Proposal 2A sets out certain proposed amendments to the Company’s Articles of Association and Proposal 2B sets out certain proposed amendments to the Company’s Memorandum of Association. Under Irish law, any amendment to a public company’s Articles of Association must be voted on separately from any amendment to a public company’s Memorandum of Association. For that reason, we are asking shareholders to vote separately on Proposals 2A and 2B. However, given the inextricable link between Proposals 2A and 2B, each proposal is subject to the other being approved by shareholders and, as a result, both proposals will fail if either proposal does not pass.

Set forth below is background information on the proposed amendments to the Company’s Articles of Associationpursuant to this proposal. The description of the following proposed amendments is only a summary and is qualifiedin its entirety by reference to the complete text of the proposed amendments, which is attached to this Proxy Statement as Part 1 of Appendix A. We urge you to read Part 1 of Appendix A in its entirety before casting your vote.

On June 1, 2015, the Companies Act 2014 took effect in Ireland. The Companies Act 2014 is meant to consolidate and modernize company law in Ireland. Although the changes to Irish company law will not impact the Company’s day-to-day operations, we must make certain administrative updates to the Company’s Articles of Association to ensure that these operations are not impacted or affected by the introduction of this new law.

As an example, the Companies Act 2014 will automatically apply certain sections of the Act to the Company unless we explicitly opt out. Given that many of these sections either address matters that are already covered by the Company’s Articles of Association or are not applicable to the Company, we are proposing to amend the Company’s Articles of Association to explicitly opt out of certain provisions, as permitted by the Companies Act 2014. For example, the Companies Act 2014 includes a provision regarding the appointment of directors, which is already covered by existing provisions in the Company’s Articles of Association. Therefore, we recommend opting out of that provision.

Attached as Appendix B to this Proxy Statement is a table that sets out a summary of the optional provisions from which we propose to opt out, a table that sets out a summary of the optional provisions from which we propose not to opt out, as well as certain other general administrative amendments that we propose to make to the Company’s Articles of Association.

As required under Irish law, the resolution in respect of Proposal 2A is a special resolution that requires the affirmative vote of the holders of at least 75% of the votes cast. In addition, Proposal 2A is subject to Proposal 2B being adopted. Therefore, unless shareholders approve Proposal 2B, Proposal 2A will fail.

THE TEXT OF THE RESOLUTION IN RESPECT OF PROPOSAL 2A IS AS FOLLOWS:

“Asaspecialresolutionthat,subjecttoandconditionaluponProposal2Bbeingpassed,theArticlesofAssociationbeandherebyareamendedinthemannerprovidedinPart1ofAppendixAofthisProxyStatement.”

|

|

EATON 2016 Proxy Statement and Notice of Meeting 19

Set forth below is background information on the proposed amendments to the Company’s Memorandum of Association pursuant to this proposal. The description of the following proposed amendments is only a summary and is qualified in its entirety by reference to the complete text of the proposed amendments, which is attached to this Proxy Statement as Part 2 of Appendix A. We urge you to read Part 2 of Appendix A in its entirety before casting your vote.

As described in Proposal 2A, on June 1, 2015, the Companies Act 2014 took effect in Ireland. In addition to the proposed amendments described above to the Company’s Articles of Association to accommodate the adoption of the Companies Act 2014, we must also make certain corresponding administrative amendments to the Company’s Memorandum of Association to account for the enactment of the Companies Act 2014. Each of the proposed amendments to the Company’s Memorandum of Association are specifically described in the text of the resolution below, as required under Irish law.

As required under Irish law, the resolution in respect of Proposal 2B is a special resolution that requires the affirmative vote of the holders of at least 75% of the votes cast. In addition, Proposal 2B is subject to Proposal 2A being adopted. Therefore, unless shareholders approve Proposal 2A, Proposal 2B will fail.

THE TEXT OF THE RESOLUTION IN RESPECT OF PROPOSAL 2B IS AS FOLLOWS:

“Asaspecialresolutionthat,subjecttoandconditionaluponProposal2Abeingpassed,thefollowingamendments,asshowninPart2ofAppendixAofthisProxyStatement,bemadetotheMemorandumofAssociation:

theMemorandumofAssociationbeandherebyisamendedbythedeletionoftheexistingclause3.16andthesubstitutionthereforofthefollowingnewclause3.16:

“3.16Toincorporateorcausetobeincorporatedanyoneormoresubsidiaries(withinthemeaningoftheCompaniesActs)oftheCompanyforthepurposeofcarryingonanybusiness.”;

theMemorandumofAssociationbeandherebyisamendedbythedeletionoftheexistingclause3.28andthesubstitutionthereforofthefollowingnewclause3.28:

“3.28Toguarantee,support,secure,whetherbypersonalcovenantorbymortgagingorchargingalloranypartoftheundertaking,propertyandassets(bothpresentandfuture)anduncalledcapitaloftheCompany,orbybothsuchmethods,theperformanceoftheobligationsof,andtherepaymentorpaymentoftheprincipalamountsofandpremiums,interestanddividendsonanysecuritiesof,anyperson,firm,orcompanyincluding(withoutprejudicetothegeneralityoftheforegoing)anycompanywhichisforthetimebeingtheCompany’sholdingcompanyasdefinedbytheCompaniesActs,orasubsidiaryasthereindefinedofanysuchholdingcompanyorotherwiseassociatedbytheCompanyinbusiness.”;and

theMemorandumofAssociationbeandherebyisamendedbythedeletionoftheexistingclause3.39andthesubstitutionthereforofthefollowingnewclause3.39:

“3.39TodistributeamongthemembersoftheCompanyincash,kind,specieorotherwiseasmayberesolved,bywayofdividend,bonusorinanyothermannerconsideredadvisable,anypropertyoftheCompany,subjectalwaystotheprovisionsoftheCompaniesActsandanyotherapplicablelaws.”

|

The Board of Directors recommends a vote FOR this proposal

EATON 2016 Proxy Statement and Notice of Meeting 20

The description of the following proposed amendments is only a summary and is qualified in its entirety by reference to the complete text of the proposed amendments, which is attached to this Proxy Statement as Appendix C. We urge you to read Appendix C in its entirety before casting your vote.

Proposal 3 sets out certain proposed amendments to the Company’s Articles of Association to clarify that the Board has the sole authority to set its size within the fixed limits set out in the Articles of Association. The amendments are designed to clarify the voting standard to be used in director elections at shareholder meetings. The Company’s Articles of Association provide for majority voting in uncontested director elections. Under this standard, each shareholder is entitled to one vote per share for each director position, and only candidates receiving a majority of votes cast are elected. The Articles of Association provide for a plurality voting standard in contested director elections. Plurality voting will be used if the number of director nominees exceeds the size of the Board. Under this standard, each shareholder is entitled to one vote per share for each director position, and the nominees receiving the most votes for those positions are elected. The proposed amendments to the Articles of Association do not change these voting standards. They instead clarify that a contested election involving plurality voting will occur if the number of director nominees exceeds the number of directors fixed from time to time by the Board, rather than the maximum allowable size of the Board contained in the Articles of Association.

As with plurality voting in contested elections, granting the Board sole authority to set its size is a common governance practice in the United States. The overwhelming majority of the 100 largest U.S. public companies have granted their Boards sole authority to set the size of the Board. Accordingly, Proposal 3 seeks shareholder approval to amend the Company’s Articles of Association to grant the Board sole authority to set its size within the parameters established in the Company’s Articles of Association.

As required under Irish law, the resolution in respect of Proposal 3 is a special resolution that requires the affirmative vote of the holders of at least 75% of the votes cast.

THE TEXT OF THE RESOLUTION IN RESPECT OF PROPOSAL 3 IS AS FOLLOWS:

“AsaspecialresolutionthattheArticlesofAssociationbeandareherebyamendedinthemannerprovidedinAppendixCofthisProxyStatement.”

|

|

EATON 2016 Proxy Statement and Notice of Meeting 21

Shareholders are being asked to appointapprove the appointment our independent auditor and to authorize the Audit Committee of our Board of Directors to set the auditor’s remuneration. Appointment of the independent auditor and authorization of the Audit Committee to set its remuneration require the affirmative vote of a majority of the votes cast by the holders of ordinary shares represented at the annual general meeting in person or by proxy. The Audit Committee and the Board recommend that shareholders reappoint Ernst & Young LLP as our independent auditor to audit our accounts for the fiscal year ending December 31, 20162018 and authorize the Audit Committee of the Board to set the auditor’s remuneration.

A representative of Ernst & Young LLP will be present at the annual general meeting to answer any questions concerning the independent auditor’s areas of responsibility and will have an opportunity to make a statement if he or she desires to do so.

The Audit Committee of the Board of Directors is responsible for assisting the Board in overseeing: (1) the integrity of the Company’s consolidated financial statements and its systems of internal accounting and financial controls;controls, (2) the independence, qualifications and performance of the Company’s independent auditor;auditor, (3) the performance of the Company’s internal auditors;auditors, and (4) the Company’s compliance with legal and regulatory requirements. The Committee’s specific responsibilities, as described in its charter, include the sole authority to appoint, terminate and compensate the Company’s independent auditor, and to pre-approve all audit services and other permitted non-audit services to be provided to the Company by the independent auditor. The Committee is currently comprised of five directors, all of whom are independent under the Sarbanes-Oxley Act of 2002, the rules of the Securities and Exchange Commission and the Board of Directors’ own independence criteria.

The Board of Directors amended the Committee’s charter most recently on October 22, 2013.24, 2017. A copy of the charter is available on the Company’s website at http://www.eaton.com/governance.

The Audit Committee has retained Ernst & Young LLP as Eaton’s independent auditor for 2016.2018. Ernst & Young has been the independent auditor for the Company or its predecessor since 1923. The members of the Audit Committee and the Board believe that due to Ernst & Young’s deep knowledge of the Company and of the industries in which the Company operates, it is in the best interests of the Company and its shareholders to continue retention of Ernst & Young to serve as Eaton’s independent auditor.

In carrying out its responsibilities, the Audit Committee has reviewed, and has discussed with the Company’s management and independent auditor, the Company’s 20152017 audited consolidated financial statements and the assessment of the Company’s internal control over financial reporting.

The Committee has also discussed with Ernst & Young the matters required to be discussed by applicable auditing standards.

The Committee has received the written disclosures from Ernst & Young regarding their independence from the Company that are required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence, has discussed with

Ernst & Young their independence and has considered whether their provision of non-audit services to the Company is compatible with their independence. Based upon the foregoing review and discussions, the Committee recommended to the Board that the financial statements be included in the Company’s Form 10-K for the year ended December 31, 20152017 and annual report to shareholders.

EATON 2016

| EATON2018 Proxy Statement and Notice of Meeting | 19 |

For 2017 and Notice of Meeting 22

For 2015 and 2014,2016, Ernst & Young’s fees to the Company and certain of its subsidiaries were as follows:

| 2015 | 2014 | 2017 | 2016 |

Audit Fees | $25.7 million | $27.7 million | $20.6 million | $21.2 million |

Includes Sarbanes-Oxley Section 404 attest services |

|

|

|

|

Audit-Related Fees | $0.3 million | $0.2 million | $0.2 million | $0.3 million |

Includes business acquisitions and divestitures |

|

|

|

|

Tax Fees | $3.7 million | $3.9 million | $3.6 million | $2.1 million |

Tax compliance services | $2.2 million | $1.8 million | $1.0 million | $1.2 million |

Tax advisory services | $1.5 million | $2.1 million | $2.6 million | $0.9 million |

All Other Fees | $0 | $0 | $0 | $0 |

The Audit Committee approved all of the services shown in the above three categories in accordance with the Audit Committee’s pre-approval process. The Audit Committee did not approve any of the services shown in the above three categories through the use of the “de minimis” exception permitted by Securities and Exchange Commission rules.

The Audit Committee has adopted the following procedure for pre-approving audit services and other services to be provided by the Company’s independent auditor: specific services are pre-approved from time to time by the Committee or by the Committee Chair on its behalf. As to any services approved by the Committee Chair, the approval is made in writing and is reported to the Committee at the following meeting of the Committee.